Dear All (and with thanks to Kevin for co-authoring and also a wonkish alert … get your coffee and settle in for the details),

If you’ve been around the antibiotic ecosystem for a while, you’ve hopefully heard the story of the 2019 bankruptcy of Achaogen and the subsequent loss to the entire world of its aminoglycoside, plazomicin. A recently published post-mortem by Wells, Nguyen, and Harbarth gives us a deeply insightful and sobering financial perspective on those events. The paper is required reading — and here are the links you need to follow the plot:

- The primary paper: Nadya Wells, Vinh-Kim Nguyen, & Stephan Harbarth. Novel insights from financial analysis of the failure to commercialise plazomicin: Implications for the antibiotic investment ecosystem. Humanit Soc Sci Commun 11, 941 (2024). https://doi.org/10.1057/s41599-024-03452-0.

- Download this and read it in its entirety.

- The supplemental materials provide some useful numerical summaries.

- Newsletters that give you a feel for the collapse of plazomicin in real-time

- 22 April 2019: “Scary, Scarier, Scariest: Achaogen / FT editorial / CBS “60 Minutes” on AMR”: Reviews an excellent summary by Alan Carr of the bankruptcy along with a sobering editorial by Jeremy Farrar (at that time, Director of Wellcome Trust) that concludes that There is no viable path for new drugs, however valuable they are to society.”

- 11 July 2020: “Plazomicin EU marketing application is withdrawn: Near zero market value of newly approved antibacterials”: EMA offers to approve it but Cipla (the new owner) says “Thanks, but no thanks” in an open letter that highlights the financial issue.

- Finally, see below our signatures if you need a reminder of the properties of plazomicin

- Summary: A valuable drug for Gram-negative infections because it maintains activity in the presence of resistance mechanisms that inactive other drug classes (e.g., beta-lactams) in Enterobacteriales. Because of that it would definitely would be valuable in the clinic from time to time … and that’s exactly the pattern of use we would like to see for all new antibiotics!

The deep-dive into the cold, hard facts: What did the authors find?

- The authors (a team from the Geneva Graduate Institute and the University of Geneva) reviewed public regulatory documents, financial statements, investor presentations, and bankruptcy documents to enable them to reconstruct the entire history of Achaogen and plazomicin from a financial standpoint.

- Key results

- Phase 1 began in 2009, approval in 2018 was based on a Phase 3 trial in complicated UTI vs. meropenem.

- The approved indication was limited to cUTI in patients with limited or no treatment options.

- Efforts to generate data in highly resistant pathogens in a comparison with colistin-based therapies were stopped for futility when only 39 patients had been enrolled despite screening ~2,000 patients.

- The limited data were consistent with activity.

- Financially, the company raised close to $800m ($776 per our tally)

- But, all was for naught: sales were dismal and ultimately the company was sold at auction for $16m to Cipla and Sihuan Pharmaceutical (China)..

- And plazomicin to date has limited availability in the US and India. There is a global named patient access program.

The heart of the paper: What did the authors conclude? Here you need to be sure to read the paper as it contains a wealth of detailed analyses. Ultimately, these are the big findings:

- “Novel antibiotics with narrow approval for small patient populations affected by severe resistant infections cannot be successfully commercialized in the current US antibiotic market.

- “SMEs need incentive payments structured to enable them to survive the commercialisation cashflow drought.

- “These changes are necessary to restore industry and financial investor confidence in the antibiotic SME development model.”

Let’s take them bit by bit.

1. “Novel antibiotics with narrow approval for small patient populations affected by severe resistant infections cannot be successfully commercialized in the current US antibiotic market.”

- Read all that very carefully … it’s a big statement.

- The authors argue (and correctly, we think) that it could be said that plazomicin was the wrong drug (there is a strong dislike for aminoglycosides in the US due to their toxicities) in the wrong place (the US guidelines and microbiology practices made use of plazomicin difficult) at the wrong time (infections requiring plazomicin are uncommon as yet in the United States).

- But, and its a VERY big but similar problems have contributed to the failure of many other agents: the difficulties of eravacycline, omadacycline, and lefamulin are all discussed briefly. As the authors note: “Can they really all be ‘bad drugs’?” No — the problems are deeper.

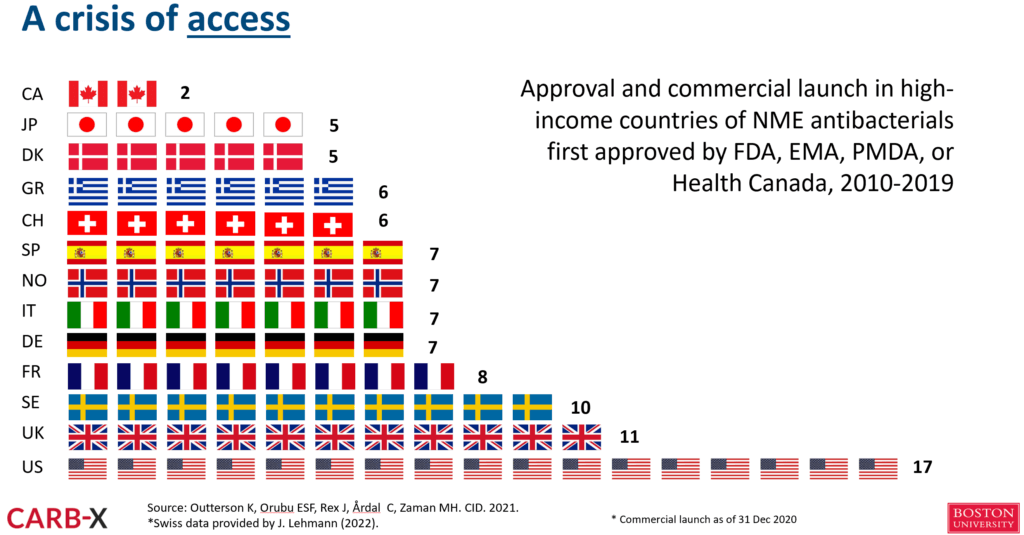

- One way to see the depth of the problem is to look at the delays in access even in high-income countries that were analyzed in 2021 by Outterson et al.:

- Source paper: Outterson et al.: Patient access in fourteen high-income countries to new antibacterials approved by the FDA, EMA, PMDA, or Health Canada, 2010-2020. Clinical Infectious Diseases. 2021 (doi: 10.1093/cid/ciab612).

- See also the 19 Aug 2021 newsletter and related YouTube video.

- In brief, both innovative and noninnovative antibiotics reached these major markets only after some years, if at all:

- So, it’s not just the US market that is broken!

2. “SMEs need incentive payments structured to enable them to survive the commercialisation cashflow drought”

- SMEs (Small and Medium-sized Enterprises) are the engines of our ingenuity but the “SMEs that drive the antibacterial pipeline experience high turnover rates in preclinical development; only a few programmes advance to clinical trials.” and they have “extremely limited financial, scientific and technical resources” per a 2024 report from WHO.

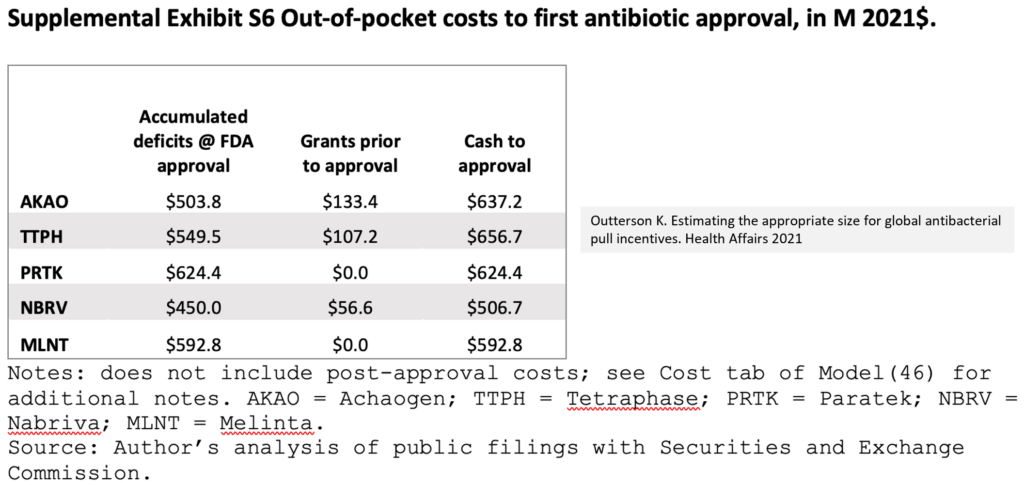

- The costs of bringing a new antibiotic to the market are substantial!

- From Outterson 2021 (same link as above), the needs for cash prior to first approval for five recent antibiotics have been in the range of $500-600m::

- And after that, the costs of then keeping a drug on the market are substantial!

- A well-supported estimate based on the Achaogen experience is ~$350m for the first 10 years after approval. These are costs for manufacturing, pharmacovigilance, pediatric development, and other post-approval commitments.

- These costs and cashflow needs cannot be covered by the inevitably small revenues from an antibiotic which is to be reserved for small patient populations

- For more on post-approval costs, see the video of the Antibiotic Bootcamp for Developers entitled “Post-approval economics for new antibiotics” from the 3-6 Sep 20219 ASM/ESCMID Conference on Drug Development.

- For more on post-approval costs, see the video of the Antibiotic Bootcamp for Developers entitled “Post-approval economics for new antibiotics” from the 3-6 Sep 20219 ASM/ESCMID Conference on Drug Development.

3. “These changes are necessary to restore industry and financial investor confidence in the antibiotic SME development model.”

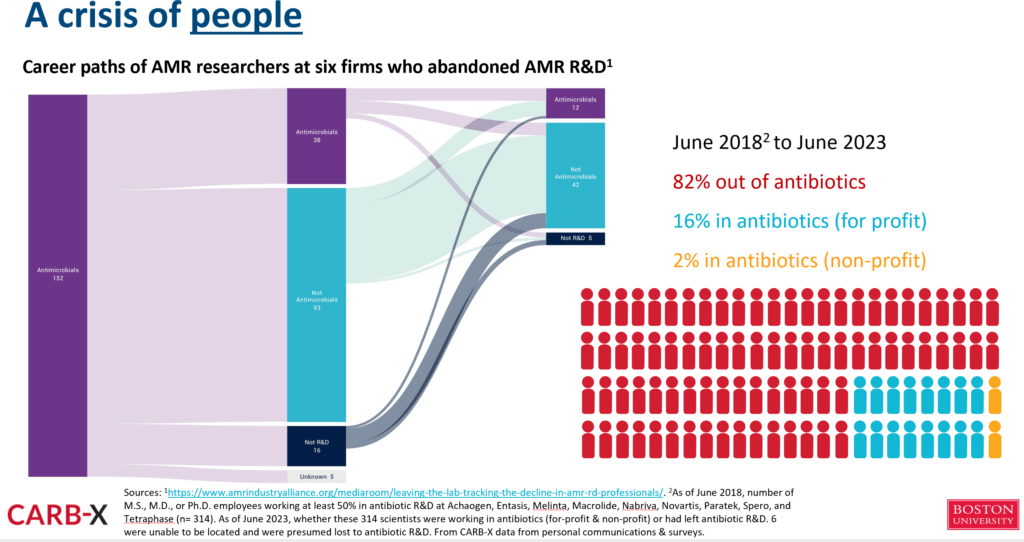

- In summary, the antibiotic pipeline relies on SMEs and they cannot fund commercialisation in the current environment.

- Ultimately, we are talking about the need for delinked reimbursement models.

- Antibiotics are the #FireExtinguishersOfMedicine and need to be reimbursed for their STEDI (fire extinguisher-like) values

- That’s why we need continued action at national levels globally. The recent HLM during UNGA has moved things to the next level (brief YouTube clip, AMR.Solutions UNGA HLM AMR webpage). Now we need the PASTEUR Act in the US! Pull models from Canada, Australia, Japan, and Switzerland! Pull incentives from the European Commission!

- And, that’s just confidence by industry and investors. The other thing we are losing over time are the people who know how to make all this happen. As was discussed in the 8 Feb 2024 newsletter (“Leaving the lab: The decline in AMR R&D professionals”), people who start in AMR R&D are only occasionally able to stay in that therapy area:

—

Wow! Many thanks to Wells, Nguyen, and Harbarth for this excellent and thought-provoking summary. Please do make time to read it … the interlocking details of the story are very compelling.

It really is time to #PassPASTEUR!

All best wishes, John & Kevin

John H. Rex, MD | Chief Medical Officer, F2G Ltd. | Operating Partner, Advent Life Sciences. Follow me on Twitter: @JohnRex_NewAbx. See past newsletters and subscribe for the future: https://amr.solutions/blog/. All opinions are my own.

Kevin Outterson, JD, Professor of Law, Boston University & Executive Director, CARB-X (these views are personal and do not necessarily reflect the views of CARB-X or any of its funders) @koutterson

A brief primer on plazomicin:

- Plazomicin (ZEMDRI) is a novel aminoglycoside antibacterial developed by Achaogen to treat infections caused by highly resistant Enterobacteriales (Enterobacteriaceae).

- Clark JA, Burgess DS (2020) Plazomicin: A new aminoglycoside in the fight against antimicrobial resistance. Ther Adv Infect Dis https://doi.org/10.1177/2049936120952604.

- At a technical level, it was designed to evade resistance mechanisms specific to aminoglycosides (bacteria become resistant by acquiring gene coding for aminoglycoside-modifying enzymes that inactivate aminoglycosides).

- In addition, it maintains activity in the presence of most mechanisms that lead to resistance in Enterobacteriales vs. other classes, including mutations in sites targeted by fluoroquinolones, the production of extended-spectrum β-lactamases, and carbapenemases, and plasmid-mediated colistin resistance that modifies the outer membrane of the bacterial cell.

- You wouldn’t be likely to use it every day (and it does carry the toxicity risks of the aminoglycosides) but it is (or, rather, would be) a useful alternative from time to time: general review from 2019; Phase 3 data in cUTI in NEJM (2019); a 2022 meta-analysis, and a 2023 surveillance data showing utility of plazomicin.

- ENABLE-2 has continuously open calls for both its Hit-to-Lead program as well as its Hit Identification/Validation incubator. Applicants must be academics and non-profits in Europe due to restrictions from the funders. Applications are evaluated in cycles … see the website for details on current timing for reviews.

- CARB-X has open calls at intervals that span four areas: (i) Therapeutics for Gram-Negatives, (ii) Prevention for Invasive Disease, (iii) Diagnostics for Neonatal Sepsis, and (iv) Proof-Of-Concept for Diagnosing Lower-Respiratory-Tract Infections. See this 6 Mar 2024 newsletter for a discussion of the call and go here for the CARB-X webpage on the call. There are multiple opportunities to submit — see the CARB-X webpage for details.

- BARDA’s long-running BAA (Broad Agency Announcement) for medical countermeasures (MCMs) for chemical, biological, radiological, and nuclear (CBRN) threats, pandemic influenza, and emerging infectious diseases is now BAA-23-100-SOL-00004 and offers support for both antibacterial and antifungal agents (as well as antivirals, antitoxins, diagnostics, and more). Note especially these Areas of Interest: Area 3.1 (MDR Bacteria and Biothreat Pathogens), Area 3.2 (MDR Fungal Infections), and Area 7.2 (Antibiotic Resistance Diagnostics for Priority Bacterial Pathogens). Although prior BAAs used a rolling cycle of 4 deadlines/year, the updated BAA released 26 Sep 2023 has a 5-year application period that ends 25 Sep 2028 and is open to applicants regardless of location: BARDA seeks the best science from anywhere in the world! See also this newsletter for further comments on the BAA and its areas of interest.

- HERA Invest was launched August 2023 with €100 million to support innovative EU-based SMEs in the early and late phases of clinical trials. Part of the InvestEU program supporting sustainable investment, innovation, and job creation in Europe, HERA Invest is open for application to companies developing medical countermeasures that address one of the following cross-border health threats: (i) Pathogens with pandemic or epidemic potential, (ii) Chemical, biological, radiological and nuclear (CBRN) threats originating from accidental or deliberate release, and (iii) Antimicrobial resistance (AMR). Non-dilutive venture loans covering up to 50% of investment costs are available. A closing date is not posted insofar as I can see — applications are accepted on a rolling basis; go here for more details.

- The AMR Action Fund is open on an ongoing basis to proposals for funding of Phase 2 / Phase 3 antibacterial therapeutics. Per its charter, the fund prioritizes investment in treatments that address a pathogen prioritized by the WHO, the CDC and/or other public health entities that: (i) are novel (e.g., absence of known cross-resistance, novel targets, new chemical classes, or new mechanisms of action); and/or (ii) have significant differentiated clinical utility (e.g., differentiated innovation that provides clinical value versus standard of care to prescribers and patients, such as safety/tolerability, oral formulation, different spectrum of activity); and (iii) reduce patient mortality. It is also expected that such agents would have the potential to strongly address the likely requirements for delinked Pull incentives such as the UK (NHS England) subscription pilot and the PASTEUR Act in the US. Submit queries to contact@amractionfund.com.

- INCATE (Incubator for Antibacterial Therapies in Europe) is an early-stage funding vehicle supporting innovation vs. drug-resistant bacterial infections. The fund provides advice, community, and non-dilutive funding (€10k in Stage I and up to €250k in Stage II) to support early-stage ventures in creating the evidence and building the team needed to get next-level funding. Details and contacts on their website (https://www.incate.net/).

- These things aren’t sources of funds but would help you develop funding applications

- AiCuris’ AiCubator offers incubator support to very early stage projects. Read more about it here.

- The Global AMR R&D Hub’s dynamic dashboard (link) summarizes the global clinical development pipeline, incentives for AMR R&D, and investors/investments in AMR R&D.

- Diagnostic developers would find valuable guidance in this 6-part series on in vitro diagnostic (IVD) development. Sponsored by CARB-X, C-CAMP, and FIND, it pulls together real-life insights into a succinct set of tutorials.

- In addition to the lists provided by the Global AMR R&D Hub, you might also be interested in my most current lists of R&D incentives (link) and priority pathogens (link).

John’s Top Recurring Meetings

Virtual meetings are easy to attend, but regular attendance at annual in-person events is the key to building your network and gaining deeper insight. My personal favorites for such in-person meetings are below. Of particular value for developers are the AMR Conference and the ASM-ESCMID conference. Hope to see you there!

- 17-20 Sep 2024 (Porto, Portugal; virtual attendance is possible): ASM/ESCMID Joint Conference on Drug Development to Meet the Challenge of Antimicrobial Resistance. Go here to register!

- 16-20 Oct 2024 (Los Angeles, USA): IDWeek 2024, the annual meeting of the Infectious Diseases Society of America. Go here for details.

- 25-26 February 2025 (Basel, Switzerland): The 9th AMR Conference 2025. Go here to register!

- 11-15 April 2025 (Vienna, Austria): ESCMID Global 2025, the annual meeting of the European Society for Clinical Microbiology and Infectious Diseases. Go here for details.

Upcoming meetings of interest to the AMR community:

- 16-20 Oct 2024 (Los Angeles, USA): IDWeek 2024, the annual meeting of the Infectious Diseases Society of America. See Recurring Meetings list, above.

- 16 Oct 2024 (virtual and in-person, 10a-1p ET): FDA’s Rare Disease Innovation Hub, in collaboration with the Reagan-Udall Foundation will discuss how the recently announced Rare Disease Innovation Hub can engage and prioritize its work. This may seem somewhat remote, but could this have implications for rare infections? Hmm! Attend if you can! Go here for the meeting’s webpage.

- 19-27 Oct 2024 (Annecy, France, residential in-person program): ICARe (Interdisciplinary Course on Antibiotics and Resistance). Now in its 8th year, Patrice Courvalin directs the program with the support of an all-star scientific committee and faculty. The resulting soup-to-nuts training covers all aspects of antimicrobials, is very intense, and routinely gets rave reviews! Seating is limited, so mark your calendars now if you are interested. Applications open in March 2024 — go here for more details.

- 22-24 Oct 2024 (Belgrade, Serbia): Ecraid/ESCMID postgraduate course “Better methods for clinical studies in infectious diseases and clinical microbiology”. Go here to register by 29 Sep 2024.

- 4-5 Dec 2024 (in person, Washington, DC): “Fungal Dx 2024: Fungal Diagnostics in Clinical Practice” is a 2-day in-person workshop organized by ISHAM‘s Fungal Diagnostics Working Group. The program and registration links are available at https://fungaldx.com/; the agenda is comprehensive and features an all-star global list of speakers.

- 4-5 Feb 2025 (online, 1-5p GMT timing on both days): Antimicrobial Chemotherapy Conference by GARDP and BSAC in collaboration with CEPID-ARIES and Fiocruz. Now in its 6th year, the free program offers a good review of antimicrobial R&D, ranging from drug discovery to preclinical and clinical activities. Go here to register; the abstract deadline is 15 Nov 2024.

- 11-15 April 2025 (Vienna, Austria): ESCMID Global 2025, the annual meeting of the European Society for Clinical Microbiology and Infectious Diseases. See Recurring Meetings list, above.

- [NEW] OpenWHO: “Antimicrobial Resistance in the environment: key concepts and interventions.” Per the webpage for the course, it will teach you “…why addressing AMR in the environment is essential and gain insights into how action can be taken to prevent and control AMR in the environment at the national level.” This course builds on WHO’s 2024 Guidance on wastewater and solid waste management for manufacturing of antibiotics. For further reading, see also the 25 Sep 2023 newsletter entitled “Manufacturing underpins both access and stewardship: Cefiderocol as a case study” and the 28 Jan 2024 newsletter entitled “EMA Concept Paper: Guidance on manufacturing of phage products”.